Whether you are an owner of a cottage who is considering selling, or a prospective buyer, it is important to be as informed as possible on local market conditions. In my previous career as a managing director at a major Canadian financial institution, I developed a deep appreciation for the importance of sound analytics, and have applied these concepts to glean insights on broader market trends as well as individual property valuation. In an effort to promote greater transparency and efficiency in our local markets, I am pleased to provide statistics and commentary on each of the major lakes in our core service area. If you are interested in a more precise valuation of your property, please contact me at (705) 438-3000 or email me and I would be happy to provide a value estimate at no cost.

~ David Donais, Broker of Record/Owner

2024 Mitchell Lake Market Value Summary

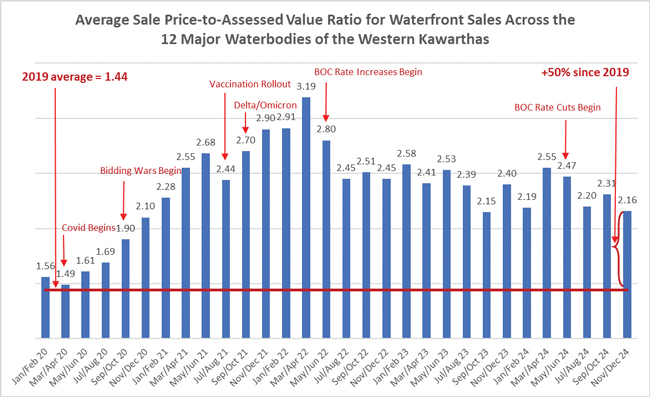

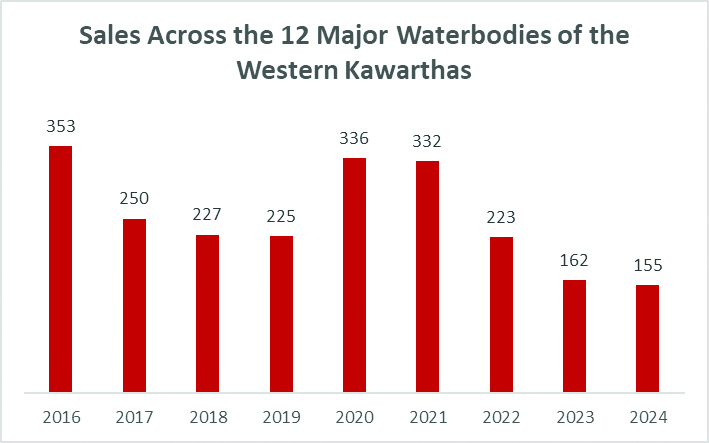

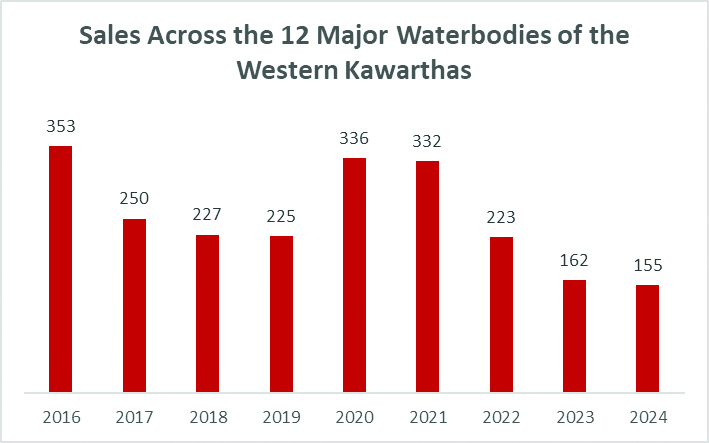

The market for waterfront properties remained very weak throughout 2024, with prices yet to respond positively to the five successive Bank of Canada rate reductions that began in June 2024.

The 12 major western Kawartha waterbodies include Balsam, Cameron, Canal, Crystal, Dalrymple, Four Mile, Head, Mitchell, Pigeon and Sturgeon lakes as well as the Shadow Lake System and the Burnt River.

Sales volumes were also extremely low in 2024, as buyers largely remained on the sidelines.

The difficulty in selling waterfront properties in 2024 was further evidenced by the fact that only 44% (155) of the 356 waterfront properties listed across the western Kawarthas in 2024 sold. And almost half (74) of those 155 properties that did sell required one or more price reductions. These 74 sales requiring price reductions were typically on the market for an extended period (median number of days on market of 136 days) and sold for significant discounts to the original list price (18% on average).

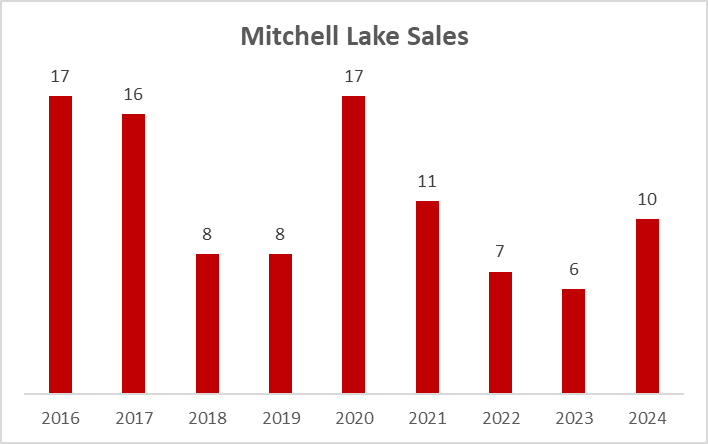

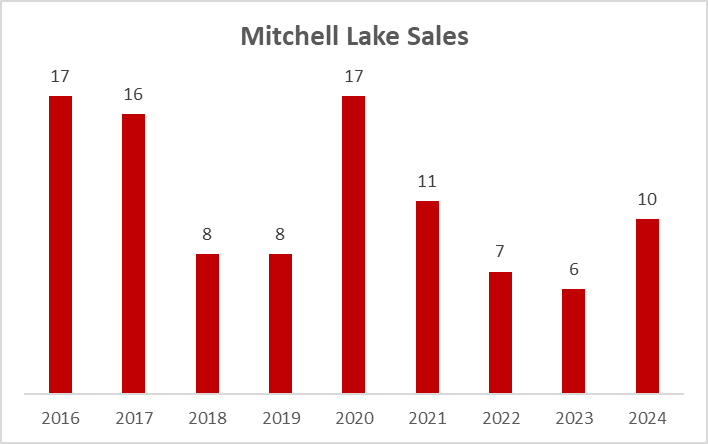

On Mitchell Lake, 19 cottage properties were listed in 2024 and 10 sold, with sale prices between $451,000 and $1,149,000, and with an average discount of 11% off the original asking price.

There are some signs of an improved market heading into 2025. 31 percent of the 155 sales in 2024 across the western Kawarthas took place after September 1st – the highest proportion since 2019. We have also been receiving higher volumes of inquiries in recent months from buyers interested in purchasing a waterfront property.

However, any rise in waterfront prices arising from higher demand may be limited by increased listing supply – the unusually low number of sales since the Covid bubble burst in mid-2022 likely means there is a significant overhang of listings poised to come to market at the first sign of improving market conditions.

2023 Mitchell Lake Market Value Summary

The 12 major western Kawartha waterbodies include Balsam, Cameron, Canal, Crystal, Dalrymple, Four Mile, Head, Mitchell, Pigeon and Sturgeon lakes as well as the Shadow Lake System and the Burnt River.

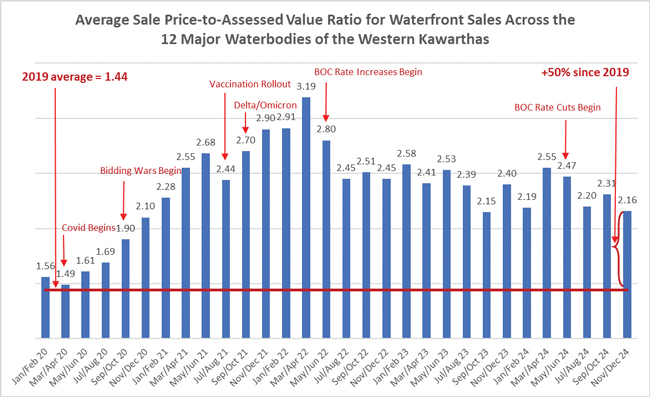

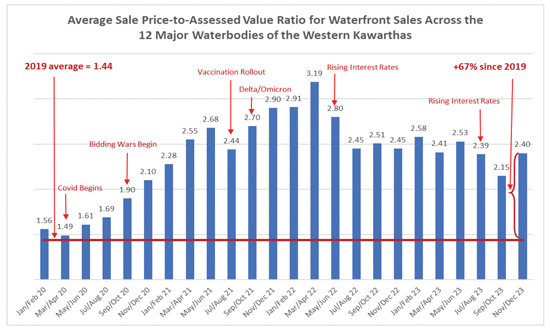

- The metric I use to track price trends is the Sale Price-to-MPAC Assessed Value Ratio, which is simply the

ratio of the sale price of an individual property to its MPAC assessed value. I calculate this ratio for each

sale recorded, as well as an average ratio for all sales in each time period.

- The chart above summarizes the average Sale Price-to-Assessed Value Ratios for the almost 1,100

waterfront sales across the 12 major waterbodies in the western Kawarthas since January 2020.

This chart effectively tells the story of the pandemic market and its aftermath.

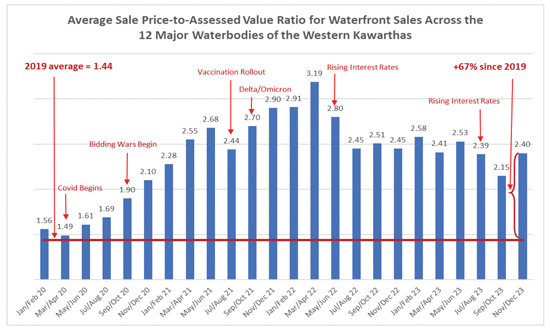

- Prices were choppy in 2023, rising early in the year, falling with the onset of the banking crisis in March,

and weakening further in the summer and early fall after the resumption of interest rate increases by the

Bank of Canada. Prices rebounded late in the year once fears of additional rate increases receded.

- Notwithstanding the unwinding of the pandemic-induced bubble, price levels remain 67% above 2019

levels.

- Consistent with most of the lakes in the western Kawarthas, sales continued to be subdued on Mitchell

Lake in 2023 with only 6 sales, down from 7 sales in 2022 and 11 sales in 2021.

- The average sale price of the 6 sales in 2023 was $617,000, down a substantial 35% from $945,000 in

2022. The decrease is attributable in part to a higher proportion of low quality properties in the 2023

sales mix. Sale prices in 2023 ranged from $540,000 to $750,000.

- The average Sale Price-to-Assessed Value ratio for the 6 sales in 2023 was 2.57, down 16% from the 3.07

ratio realized from 2022 Mitchell Lake sales but moderately higher than the average ratio of 2.39 for

waterfront sales across the western Kawarthas in 2023.

- Looking forward, I am cautiously optimistic that prices will improve in 2024 as my sense is that many

buyers feel ready to re-enter the market now that the interest rate increase cycle appears to have ended.

2022 Mitchell Lake Market Value Summary

(including sales on the TSW from the Kirkfield Lift Lock to the Simcoe County border)

Western Kawartha waterbodies include Balsam, Cameron, Sturgeon, Pigeon, Canal, Mitchell, Dalrymple, Head, Four Mile and Crystal lakes as well as the Shadow Lake System and the Burnt River.

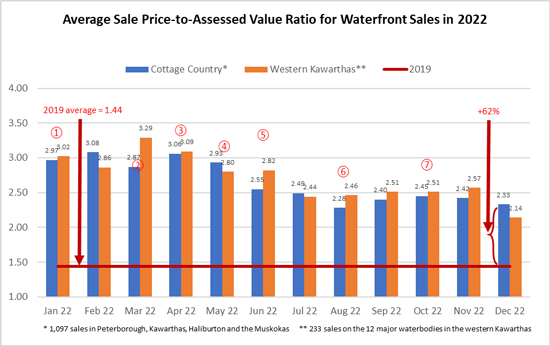

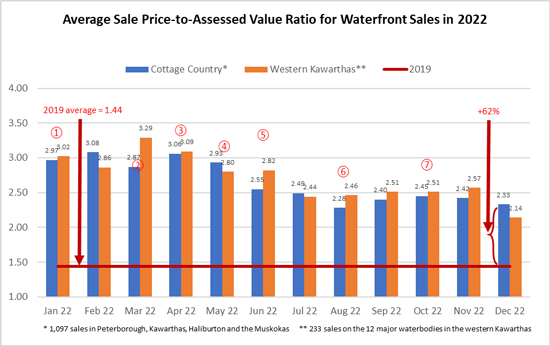

- The chart above summarizes the monthly average Sale Price-to-Assessed Value Ratios in 2022 for the

12 major waterbodies in the western Kawarthas as well as across the entirety of cottage country. I have

included the broader cottage country metric as the larger number of sales in this database adds credibility

to the trends. For example, there were only three sales in the western Kawarthas in December 2022 so

I would not put much faith in the 2.14 metric for that month.

- Prices reached an all-time high in the early months of 2022 as buyers with pre-approved financing at

very low rates chased the few waterfront listings on the market. The result was fierce bidding wars and

sale prices substantially over asking. Buyers became extremely cautious once interest rates started to

increase in late spring, and prices fell materially throughout the summer months before stabilizing in the

autumn. Notwithstanding this retrenchment, price levels in December 2022 remained 62% above

pre-pandemic levels.

- There were 7 sales on Mitchell Lake in 2022, down from 11 in 2021 and 17 in 2020.

- Sale prices on Mitchell Lake outperformed the broader market in 2022. The red circles on the chart

correspond to the month and assessed value multiples of the 7 Mitchell Lake sales. The average sale

price-to-assessed value multiple for the 7 sales was 3.07, substantially higher than the 2.65 average

multiple realized across cottage country and the 2.75 average multiple for the 12 major waterbodies in

the western Kawarthas in 2022.

- The average sale price of the 7 Mitchell Lake sales was $945,000, up 23% from $770,000 in 2021.

Sale prices ranged from $620,000 to $1,225,000.

- It is difficult to predict how prices will evolve over the next 12 months but my sense is that we will

return to normal market conditions with relatively stable prices once the rate increase cycle ceases.

2021 Mitchell Lake* Market Value Summary

*Incorporates waterfront sales on Mitchell and on the Trent-Severn Waterway between Balsam Lake and the Kirkfield Lift Lock.

**Incorporates sales on Balsam, Cameron, Sturgeon, Canal, Mitchell, Dalrymple, Head, Shadow and Four Mile lakes as well as the Burnt River.

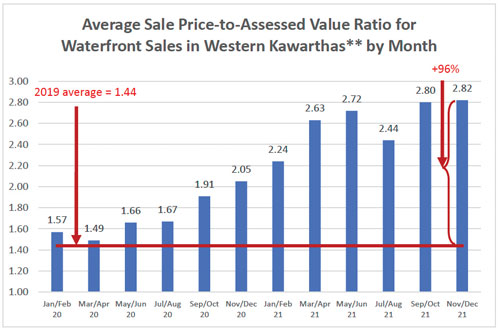

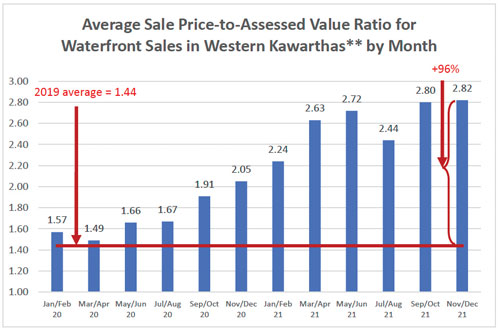

- The chart above summarizes the average Sale Price-to-Assessed Value Ratio for the 570 waterfront sales

across the key waterbodies in the western Kawarthas since January 2020. This chart is the most effective

measure of waterfront price trends due to the large number of data points and the fact that average

sale price-to-assessed value ratios tend to be quite consistent across the major waterbodies in the

western Kawarthas.

- Waterfront prices continued to trend higher through 2021 and ended the year at historic highs and

almost double 2019 levels as pandemic-induced demand reached unprecedented levels. The only

interruption in this upward trend occurred in July and August of 2021 when buyer demand receded in

the expectation that the pandemic would soon be over following the wide vaccination rollout. Demand

and prices quickly bounced back once the Delta and Omicron variants emerged.

- There were 11 properties sold on Mitchell Lake in 2021, down from 17 sales in 2020. The sales were

heavily concentrated in the first half of the year, with only 2 sales taking place after June 30th.

- The average sale price on Mitchell Lake in 2021 was $770,000, up 40% from $551,000 in 2020.

Sale prices ranged from $410,000 to $1,255,000, with the latter representing an all-time high sale price for a waterfront property on Mitchell Lake.

- 7 of the 11 sales in 2021 sold above the asking price, reflective of the dominant strategy of setting an

attractive list price and holding back offers in the hope of receiving multiple offers and above-asking sale

prices.

- Looking forward, it is difficult to foresee any material reduction in buyer demand and prices in the

coming year unless we see the cessation of the pandemic and a return to pre-Covid living conditions

and/or materially higher interest rates.

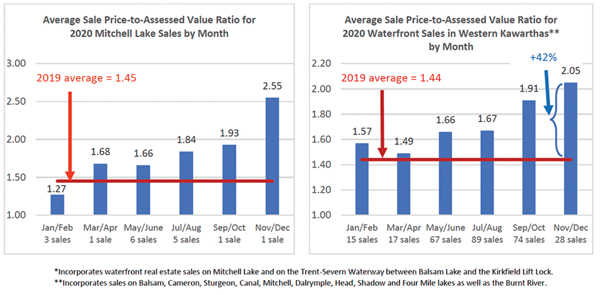

2020 Mitchell Lake Market Value Summary

- Waterfront market activity on Mitchell Lake and across the western Kawarthas was especially volatile

throughout 2020. It is therefore necessary to analyze the sales data on a monthly basis in order to

understand the underlying price trends.

-

The metric I use to track price trends is the Sale Price-to-MPAC Assessed Value Ratio, which is

simply the ratio of the sale price of an individual property to its MPAC assessed value. I calculate this

ratio for each sale recorded, as well as an average ratio for all sales over a given time period. I

consider the extent to which the average changes over time a good proxy for waterfront price trends.

-

The charts above summarize the average Sale Price-to-Assessed Value Ratios for each two-month

period in 2020. I have included a chart for both Mitchell Lake and for waterfront sales across the

western Kawarthas as the latter incorporates a larger number of sales and is therefore more

statistically significant. You can see that for the western Kawarthas, prices were strong in the first two

months of 2020, slumped somewhat during the lockdown months, and increased substantially

thereafter. Most astounding are the post-September 1st results, which saw an additional upward

surge in prices from the summer. The 2.05 ratio realized from November and December sales

across the western Kawarthas is indicative of a 42% price increase from 2019, when prices were

mostly flat throughout the year.

- This increase in prices is attributable primarily to the tidal wave of new demand from buyers in the

GTA who are eager for an escape from the pandemic-induced stresses of urban living.

- The average sale price for Mitchell Lake properties (excluding building lots) in 2020 was $551,000,

up 31% from $420,000 in 2019.

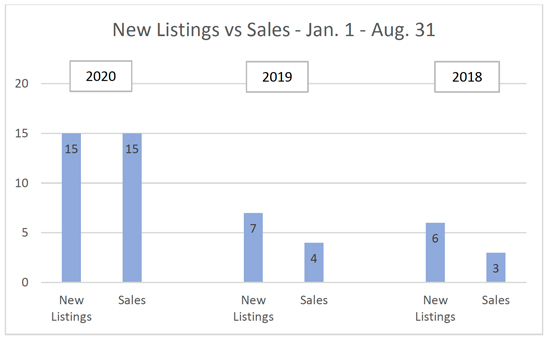

- The 17 sales on Mitchell Lake in 2020 were more than double the historically low 8 sales in 2019.

-

Looking forward, I am optimistic that 2021 will continue to be positive for the waterfront market,

supported by the apparent seismic shift in buyer demand towards waterfront properties, continued

low interest rates, and relatively strong real estate markets in the GTA.

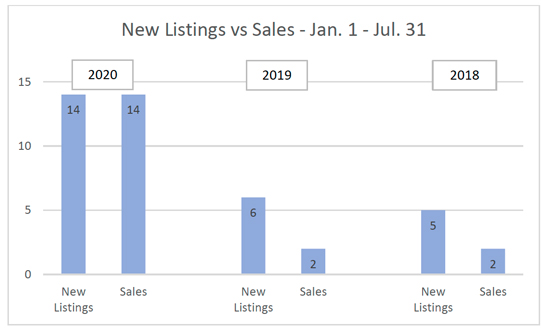

Mitchell Lake Market Value Update ~ August 31, 2020

Mitchell Lake Market Value Update ~ July 31, 2020

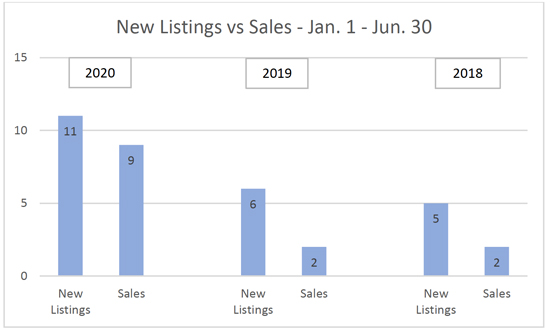

Mitchell Lake Market Value Update ~ June 30, 2020

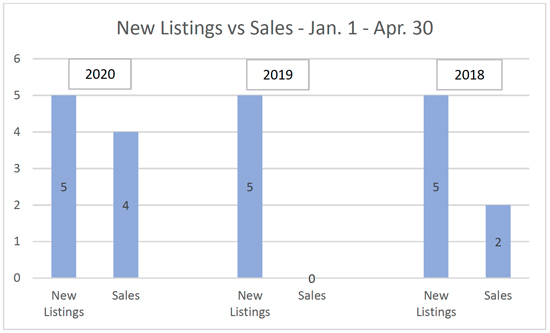

Mitchell Lake Market Value Update ~ April 30, 2020

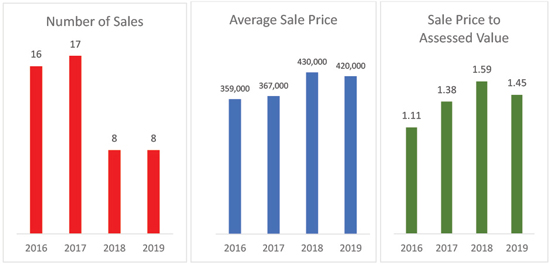

2019 Mitchell Lake Market Value Summary

- The data in this analysis captures waterfront real estate sales on Mitchell Lake and on the Trent-

Severn Waterway (TSW) from Balsam Lake to the Kirkfield Lift Lock.

- Eleven Mitchell Lake properties were put on the market in 2019 and eight (73%) sold. Four (50%) of

the eight sold properties required one or more price reductions. Across the 10 key lakes and rivers

across the western Kawarthas, of the 302 properties that were put on the market in 2019, 185 (61%)

sold, and 73 (39%) of the sold properties required price reductions.

- The average sale price of $420,000 in 2019 was down 2% from 2018. Sale prices in 2019 ranged from

a low of $232,000 to a high of $715,000.

- One metric I track closely to provide insight into pricing trends is the Sale Price-to-MPAC Assessed

Value Ratio. I calculate this ratio for each sale recorded, as well as an average ratio for all sales

during the year. In 2019, the average ratio for the eight Mitchell Lake/TSW sales was 1.45, down 9%

from the historically high ratio of 1.59 in 2018.

- Across the 10 key lakes and rivers in the western Kawarthas the average sale price-to-assessed value

ratio for the 185 waterfront sales in the region was 1.44, up 3% from 1.40 in 2018.

- Looking forward, I am cautiously optimistic that 2020 will be a positive year for the waterfront

market. I noticed strong momentum in the fall months – almost half of Kawartha Waterfront Realty’s

2019 sales took place after September 30th, and buyer inquiries to our office have remained strong

in the early winter months. Real estate market conditions in the GTA also appear to be improving,

which helps fuel demand for waterfront properties.

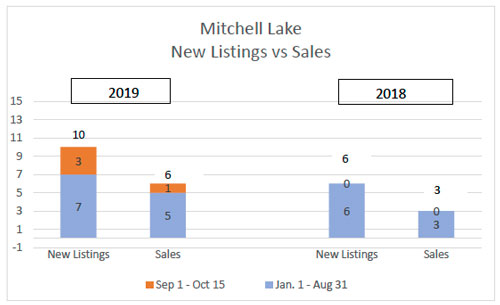

Mitchell Lake Market Value Update ~ October 15, 2019

Listing and sales activity are up from 2018 levels

- There have been three new listings and one sale on Mitchell Lake since September 1st, in contrast to no new listings or sales in the same period last year.

- The average sale price for the six sales so far in 2019 is $404,000, down from the $430,000 average sale price for all sales in 2018.

- The average sale price-to-assessed value for the four sales in 2019 sales is 1.44, down from the average of 1.59 for all sales on Mitchell Lake in 2018.

- There were five listings on Mitchell Lake as at October 15, 2019.

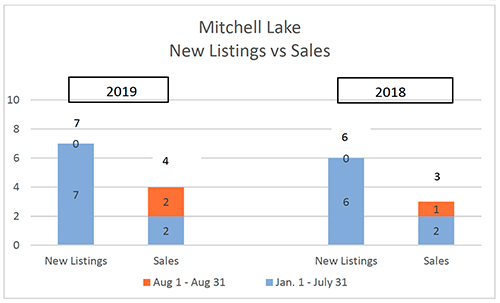

Mitchell Lake Market Value Update ~ August 31, 2019

Listing and sales activity in line with 2018 levels

- The seven new listings since January 1, 2019 are in line with the number of new listings in the same period last year.

- There were two sales in August 2019, and a total of four sales so far in 2019.

- The average sale price for the four sales so far in 2019 is $470,000, up from the $430,000 average sale price for all sales in 2018.

- The average sale price-to-assessed value for the four sales in 2019 sales is 1.49, down from the average of 1.59 for all sales on Mitchell Lake in 2018.

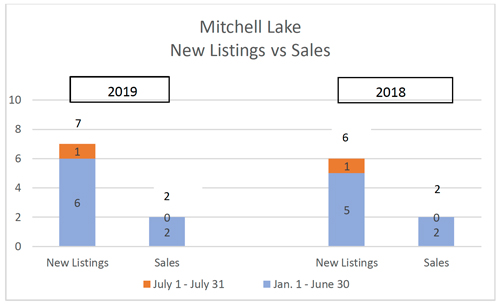

Mitchell Lake Market Value Update ~ July 31, 2019

Listing and sales activity in line with 2018 levels

- The seven new listings since January 1, 2019 are in line with the number of new listings in the same period last year.

- There have been two sales so far in 2019.

Mitchell Lake Market Value Update ~ June 30, 2019

Listing and sales activity in line with 2018 levels

- The six new listings since January 1, 2019 are in line with the number of new listings in the same period last year.

- There have been two sales so far in 2019.

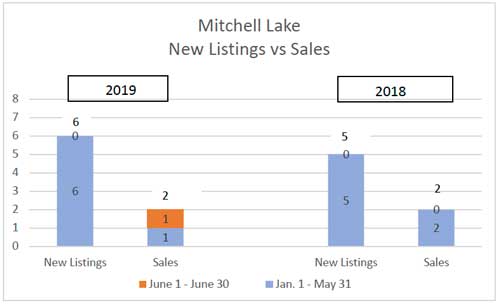

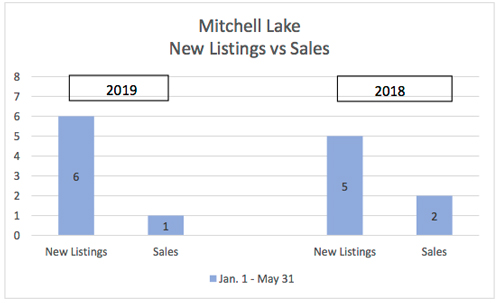

Mitchell Lake Market Value Update ~ May 31, 2019

Listing activity in line with 2018 levels

- The six new listings since January 1, 2019 are in line with the number of new listings in the same period last year.

- There has been only one sale so far in 2019.

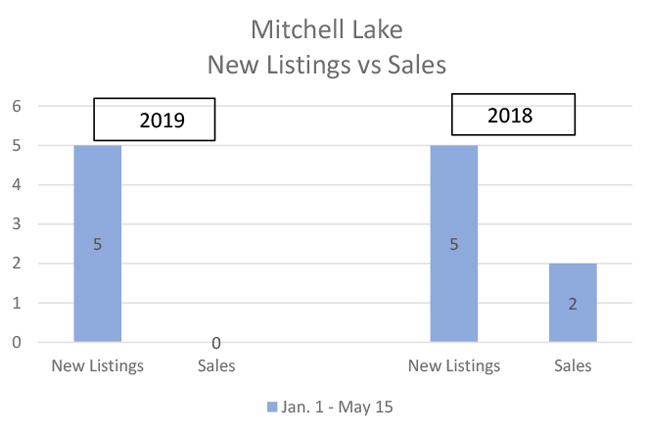

Mitchell Lake Market Value Update ~ May 15, 2019

Listing activity in line with 2018 levels

- The five new listings since January 1, 2019 are in line with the number of new listings in the same period last year.

- There have been no sales so far in 2019.

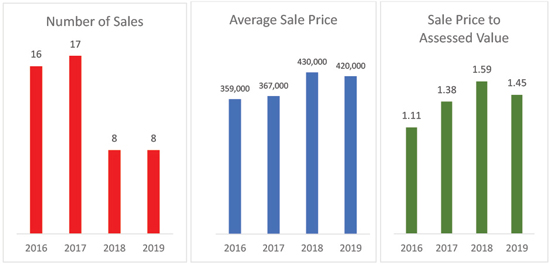

2018 Mitchell Lake Market Value Summary

- The data in this analysis captures waterfront real estate sales on Mitchell Lake and on the Trent Severn Waterway (TSW) from Balsam Lake to the Kirkfield Lift Lock.

- The average sale price for waterfront properties was $430,000 in 2018, up 17% from $367,000 in 2017

and 20% from $359,000 in 2016. Sale prices in 2018 ranged from a low of $385,000 to a high of $569,000.

- There were only eight sales in 2018, approximately half the sales volumes recorded in 2017 and 2016.

- One metric I track closely to provide insight into pricing trends is the Sale Price-to-MPAC Assessed

Value Ratio. I calculate this ratio for each sale recorded, as well as an average ratio for all sales during

the year. In 2018, the average ratio for the eight Mitchell Lake/TSW sales was 1.59, up 15% from 1.38 in 2017 and 43% from 1.11 in 2016.

- While it is hard to make any definitive conclusion on year-over-year pricing trends on Mitchell Lake/TSW

given the relatively low number of data points, the increase in both the average sale price and the Sale

Price-to-MPAC Assessed Value Ratio is encouraging. In comparison, this latter ratio when calculated

across six other key lakes in the western Kawarthas (Balsam/Cameron/Sturgeon/Head/Shadow/Four

Mile) was stable year-over-year at 1.38.

- Other key takeaways from the 2018 market include:

- In contrast to the relatively slow spring market, the fall market for waterfront properties was very

strong across the western Kawarthas.

- Buyers almost uniformly desire to use their properties year-round – if you have a three-season

property, it would be well worth your while to investigate the feasibility of enhancing it to four-

season capability.

- Looking forward, I am hoping that the strong momentum from the fall 2018 market will carry into 2019.

However, while the prospect of higher interest rates in 2019 appears to be receding, the late-2018

correction in financial markets has the potential to dampen buyer demand for waterfront properties.

As always, real estate market conditions in the GTA will heavily influence our market.